January 19, 2023 | 2 min read

Marqeta announces new web push provisioning product

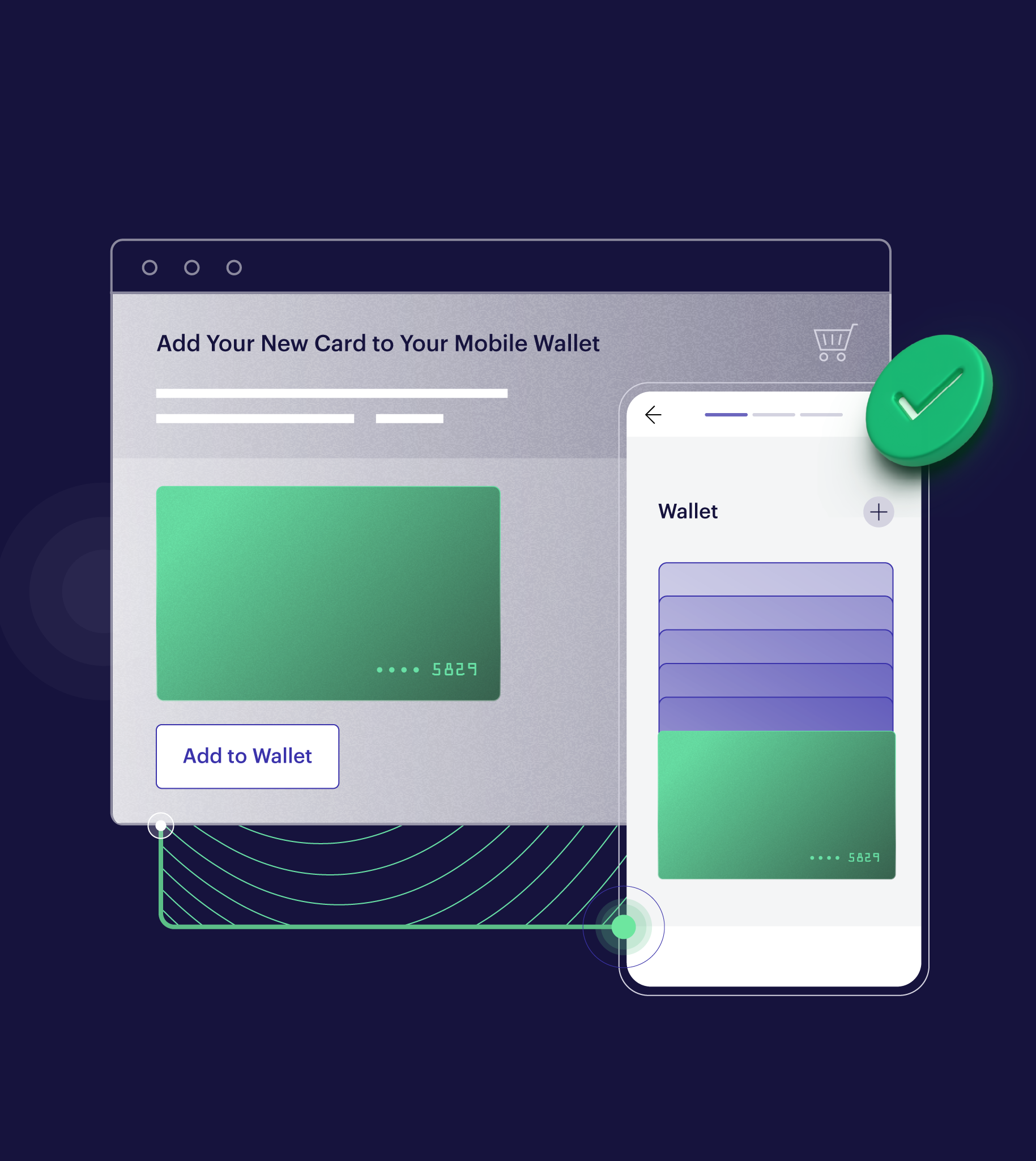

Today we announced our new web push provisioning product, enabling our customers to reduce friction at the point-of-sale and their users to pay directly from their mobile wallets, without requiring them to download a mobile application. Marqeta is one of the first card issuers to launch instant issuance capabilities, and web push provisioning further extends our leadership in this space.

Web push provisioning was first conceptualized during one of our Hack Weeks with the recent acceleration of digital wallet usage in mind. We saw how global digital wallet transaction values are expected to grow 60% by 2026, according to Juniper Research.11 Consumer adoption is also rising, with US consumers who reported using a mobile wallet in the past 12 months increasing from 64% in late 2020 to 71% in 2022, but studies show that over 75% of consumers surveyed have abandoned a transaction due to the requirement of having to download a mobile application to use services needed to check out.22

During our 2021 Winter Hack Week, a group of our talented employees identified the potential impact of enabling brands to provision tokens from a mobile web browser, allowing their users to pay directly from their mobile wallets without forcing them to transact through an app. Web push provisioning was built in partnership with digital wallet providers Apple and Google. Our customer, Bread Financial is one of the first companies to utilize this new product and we’re excited to bring the capabilities to more businesses.

“Bread Financial strives to deliver a seamless experience for our customers. As part of our disciplined product design process, the team identified friction points for our customers and partnered with Marqeta to be one of the first to bring a new and streamlined experience to market with web push provisioning. This solution allows us to offer flexible payment options that will keep the merchant’s brand at the forefront and deliver a better experience for the customer,” said Val Greer, EVP and chief commercial officer at Bread Financial. “By keeping the entire payments experience in the customer’s hands, we’re able to foster engagement that continues to bring them back to our merchants.”

Check out what this release means for developers here.