Modern card issuing to change the world

Welcome to the card issuer processor platform that enables you to build the solution that meets your exact customer needs - fast.

From global enterprises to booming startups, innovators count on Marqeta.

Our platform connects innovators like you with Visa and Mastercard, providing you with the freedom to create and control your own, bespoke card programme.

Hello innovator

You have complete control to bring your ideas to life - fast.

Marqeta's technology enables you to operate at speed, whether that be releasing new card functionality to customers or launching into new territories.

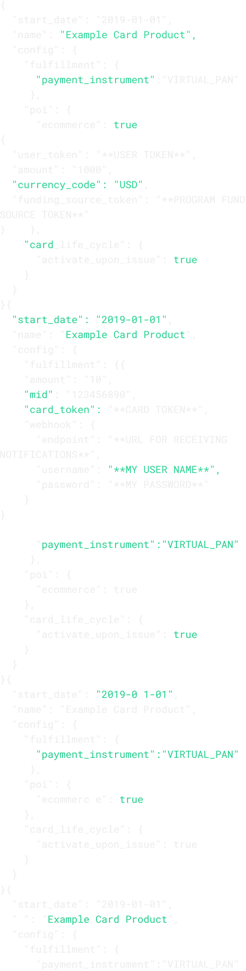

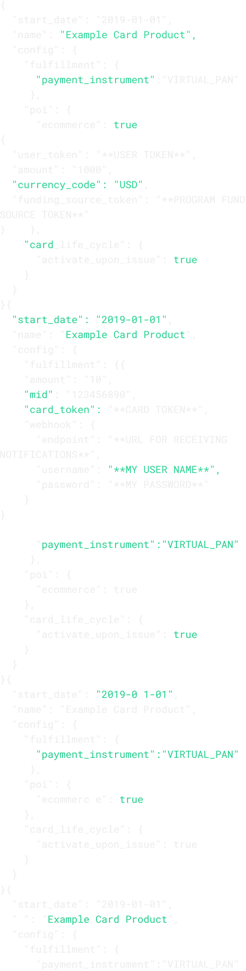

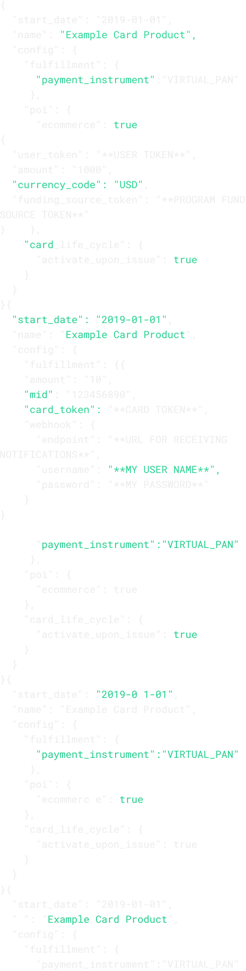

Build a card programme in hours not months. Our fully documented APIs allow you to:

Create a tailored payment experience

Create a tailored payment experience

Create new card productsUse our open APIs to create exciting new payment products.

Accelerate time to marketLaunch at the speed your developers can build at, without any dependencies on Marqeta.

TrustLeave your programme in safe hands with 99.99% platform uptime in addition to advanced fraud and spend controls.

Scale globallyIntegrate once into our global platform to support card programmes in Europe, the US, Canada and Asia.

Create new card productsUse our open APIs to create exciting new payment products.

Accelerate time to marketLaunch at the speed your developers can build at, without any dependencies on Marqeta.

TrustLeave your programme in safe hands with 99.99% platform uptime in addition to advanced fraud and spend controls.

Scale globallyIntegrate once into our global platform to support card programmes in Europe, the US, Canada and Asia.

Our mission

We stand alongside the pioneers of today and tomorrow, helping them turn their world-changing ideas into realities.

$160,000,000,000 +

volume processed in 2022

99.99%

platform uptime in 2022

10+ years

of modern issuing experience

One

integration to access a global platform

"Our developers looked at Marqeta's platform and said that's exactly how they would have built a payment processing platform if they were building from the ground up. That's why we chose to work with Marqeta."

"One of the things we value at Capital on Tap is speed - we give our customers a credit decision in less than 10 seconds. What we really valued about working with Marqeta was the speed with which they would work with us."

"We love working with Marqeta. Their ability to work at speed and cut through complexity, while always having the end consumer experience at heart, perfectly matches how we work."

Start innovating today

Let's talk about your use case and how we can help