Demystifying Cards

The card payments ecosystem and the 4-party model

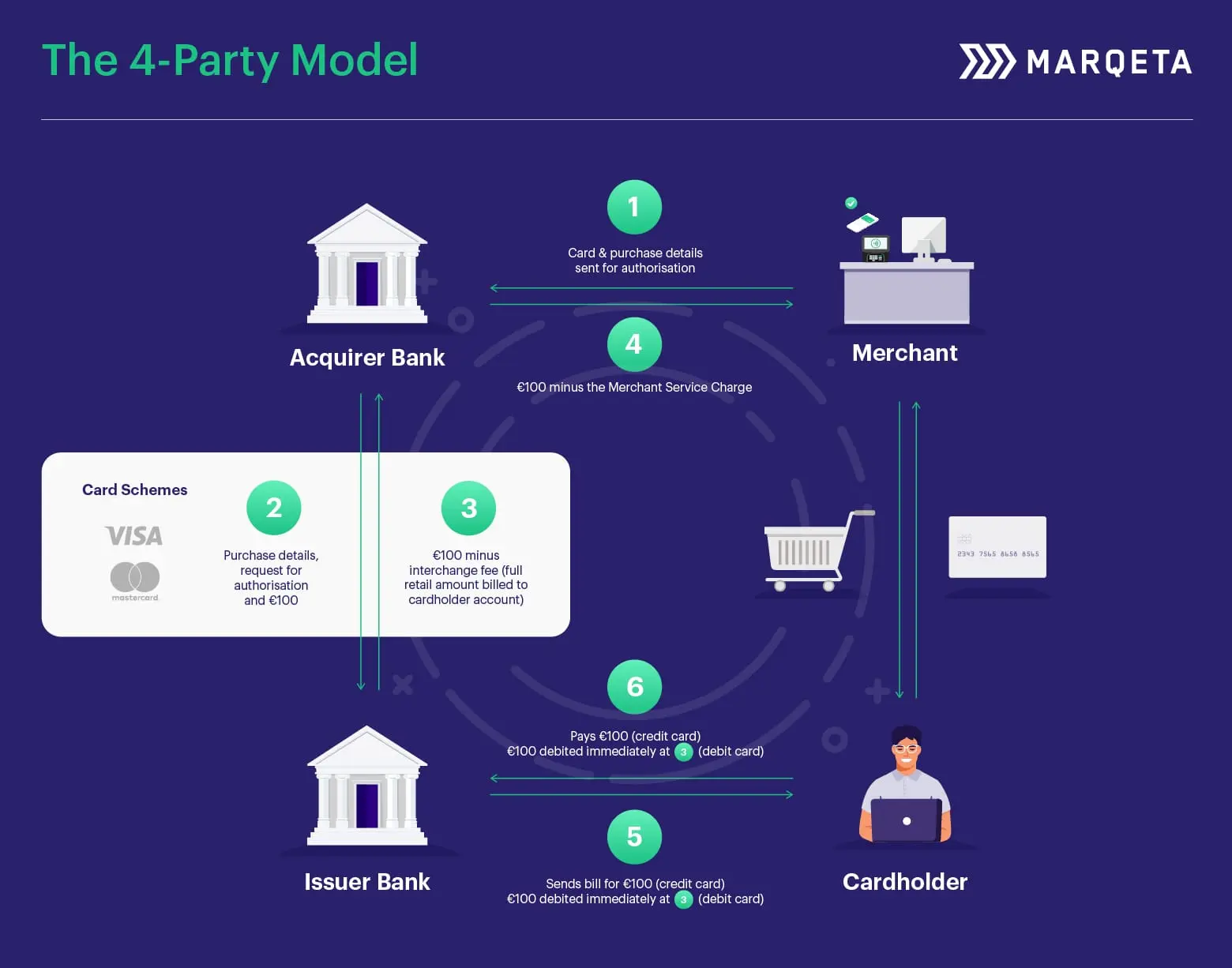

The bedrock of the card ecosystem is the ‘four-party model’. It’s the industry’s accepted framework for processing digital or physical card payments between buyers and sellers. All in a way that’s straightforward, secure, and consistent – from Azerbaijan to Zimbabwe.

If you’re wondering where Marqeta resides, we would fall under the issuer in the card ecosystem in the four party model of Merchant, Cardholder, Issuer bank and Acquirer bank.

But there are other parties involved in ensuring a swift, smooth and seamless transaction flow including the network, which as you’ve probably guessed, connects these parties.

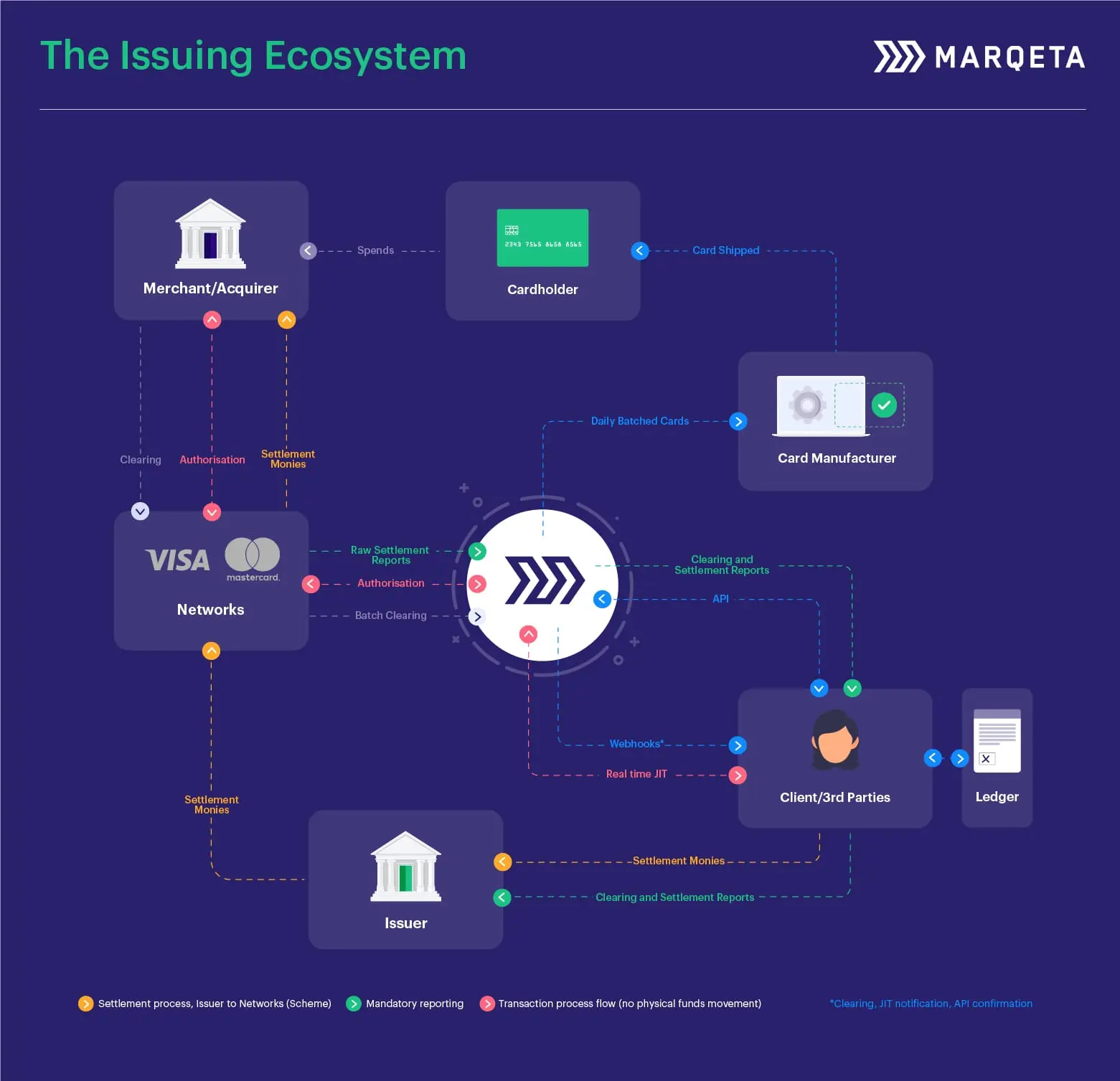

To further highlight where Marqeta sits in this key flow we have included an infographic showing how the other parties in the model interact with each other and Marqeta’s function as issuer processor. We have also included the interactions between parties in the model for authorisation of a transaction, clearing and settlement of transactions, and settlement reporting.

Drilling a bit further, Marqeta’s role as an issuer processor INCLUDES the following key areas:

Raw Settlement Reports

The raw reports that come from merchants via the networks that collate transactions from those merchants your customers have spent at and needs to be verified against the actual authorisations given.

The raw reports that come from merchants via the networks that collate transactions from those merchants your customers have spent at and needs to be verified against the actual authorisations given.

Clearing and Settlement Reports

Clearing – The process of exchanging financial transaction details between an acquirer and an issuer to facilitate posting of a cardholder’s account and reconciliation of a customer’s settlement position.

Settlement – The process by which the network (scheme) facilitates the exchange of funds on behalf of issuers and acquirers.

Clearing – The process of exchanging financial transaction details between an acquirer and an issuer to facilitate posting of a cardholder’s account and reconciliation of a customer’s settlement position.

Settlement – The process by which the network (scheme) facilitates the exchange of funds on behalf of issuers and acquirers.

Authorisation

The transaction authorisations for POS transactions, online and e-commerce transactions, ATM transactions, etc. (Via end-point connections to both Visa and Mastercard.)

The transaction authorisations for POS transactions, online and e-commerce transactions, ATM transactions, etc. (Via end-point connections to both Visa and Mastercard.)

Batch Clearing

Transactions for the clearing process are handled in large batches for efficiency rather than handled individually which we process for clients.

Transactions for the clearing process are handled in large batches for efficiency rather than handled individually which we process for clients.

Daily Batched Cards

Report sent to the card fulfilment bureau to provide a notification file of physical cards to be printed and sent to your cardholders.

Report sent to the card fulfilment bureau to provide a notification file of physical cards to be printed and sent to your cardholders.

Webhooks

Whenever an event occurs on a card, use near real time notifications to let your end users know.

Whenever an event occurs on a card, use near real time notifications to let your end users know.

Gateway JIT (Just in Time) Funding

Marqeta’s version of external authorisation – putting you in full control of every authorisation. Marqeta parses the authorisation message to you, converting ISO to JSON.

Marqeta’s version of external authorisation – putting you in full control of every authorisation. Marqeta parses the authorisation message to you, converting ISO to JSON.

API

Programming Interfaces between our applications and yours provides a much easier framework to communicate requests and makes changes much easier to implement in the future. You can look through our Core APIs are here.

Programming Interfaces between our applications and yours provides a much easier framework to communicate requests and makes changes much easier to implement in the future. You can look through our Core APIs are here.

Continue reading

Product

Legal

Location

© 2026 Marqeta, Inc. 180 Grand Avenue, 6th Floor, Oakland, CA 94612