Demystifying Cards

Launching a card programme

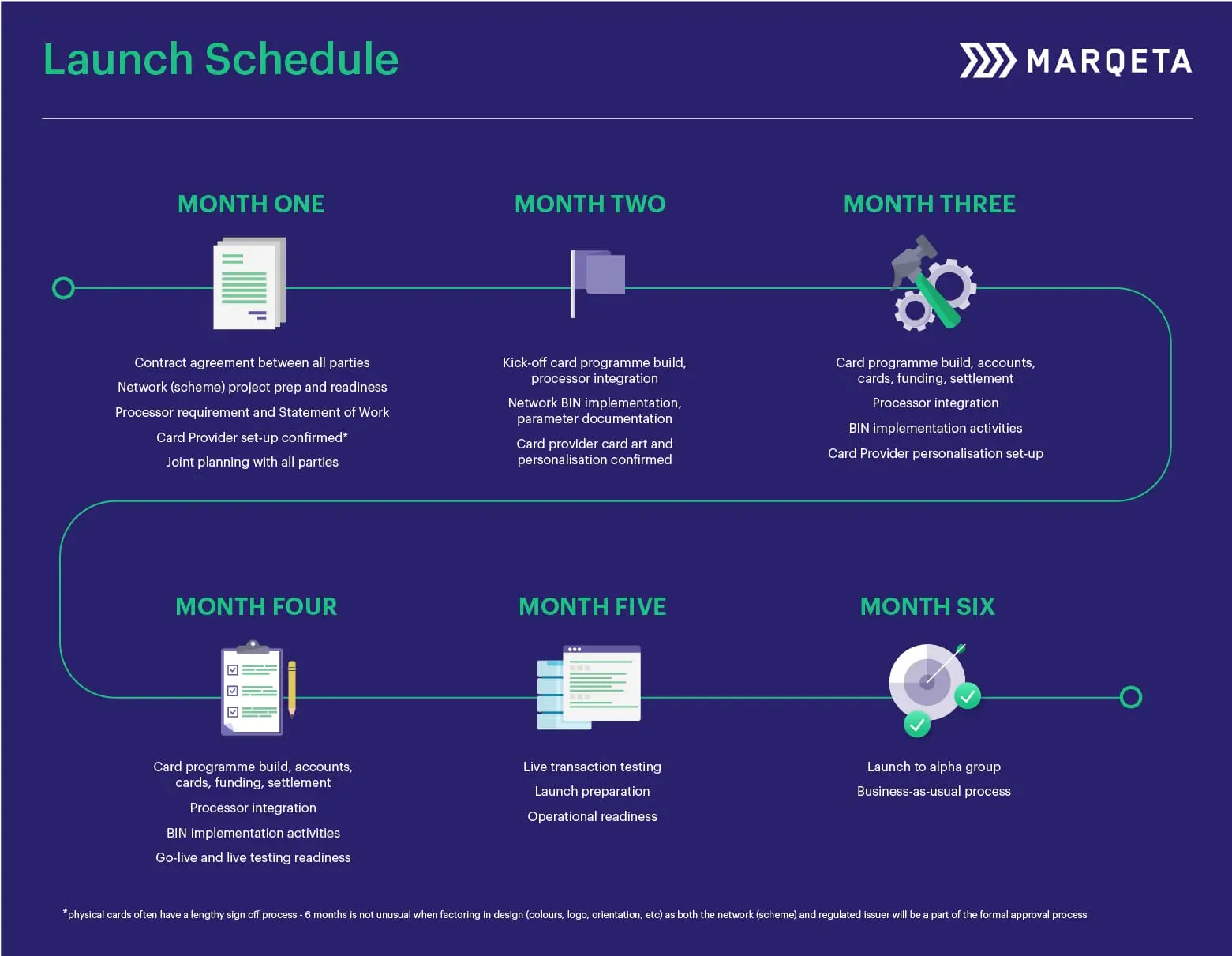

Regardless of whether you already have a license, or whether you’re going to use a BIN Sponsor or Programme Manager, you’ll need to go through the same launch journey.

Typically, this can take around six months, but can be helped or hindered by various factors. For example, your approach to licensing and network membership: will you take the faster route and piggy-back off another entity’s licence or apply for your own? Will you go for principal network (scheme) membership or use a BIN sponsor? And what kind of cards will your programme use – physical or virtual?

High-level launch schedule

We think it’s important to be able to set up the parameters of who, where and how cardholders can use their cards, using APIs in real-time. That way you can accommodate rapid change and offer an array of configurations at individual card level. Consider looking for a processor that offers dynamic spend and velocity controls, so you can have power over where a cardholder spends – for example, by country or merchant type (no gaming or alcohol, for example). Or how many times, or how much, cardholders can spend on travel or withdraw from an ATM over a pre-defined time period.

You can layer these controls together. The trick is to set controls that are flexible enough to accommodate cardholder behaviour to ensure a good payment experience, while mitigating fraud in line with your business objectives.

Putting some of these card controls in the hand of the customer is also becoming more commonplace. They may wish to pause e-commerce transactions, ATM or contactless, for example.

A notable case is Monzo including a Gambling Block option as part of their card controls area. The intention being to give those people with gambling problems the option to completely block gambling transactions.

Large financial institutions are also sitting up and taking note of customer demand for more control of their card. Santander, for example, has recently launched several new in app capabilities. View PIN, report a card lost or stolen and PIN not working functions have all been added to the app.

Fintech accelerator programmes

The payment networks have recognized that new participants want to move quicker and both have undertaken work to streamline their application processes for the new generation of Fintechs.

The payment networks have recognized that new participants want to move quicker and both have undertaken work to streamline their application processes for the new generation of Fintechs.

Visa’s Fast Track accelerator programme includes a partner toolkit to help fintechs grow faster. It also includes a certification programme, which makes it easier for fintechs to connect with certified partners for digital issuance and other key services.

Mastercard has its own equivalent. Mastercard Accelerator covers a wide range of support for fintechs at different-stages. Programmes include Mastercard Start Path, Mastercard Developers, Mastercard Engage, and Fintech Express Europe.

You’ll need to apply to join both Visa and Mastercard networks (schemes.)

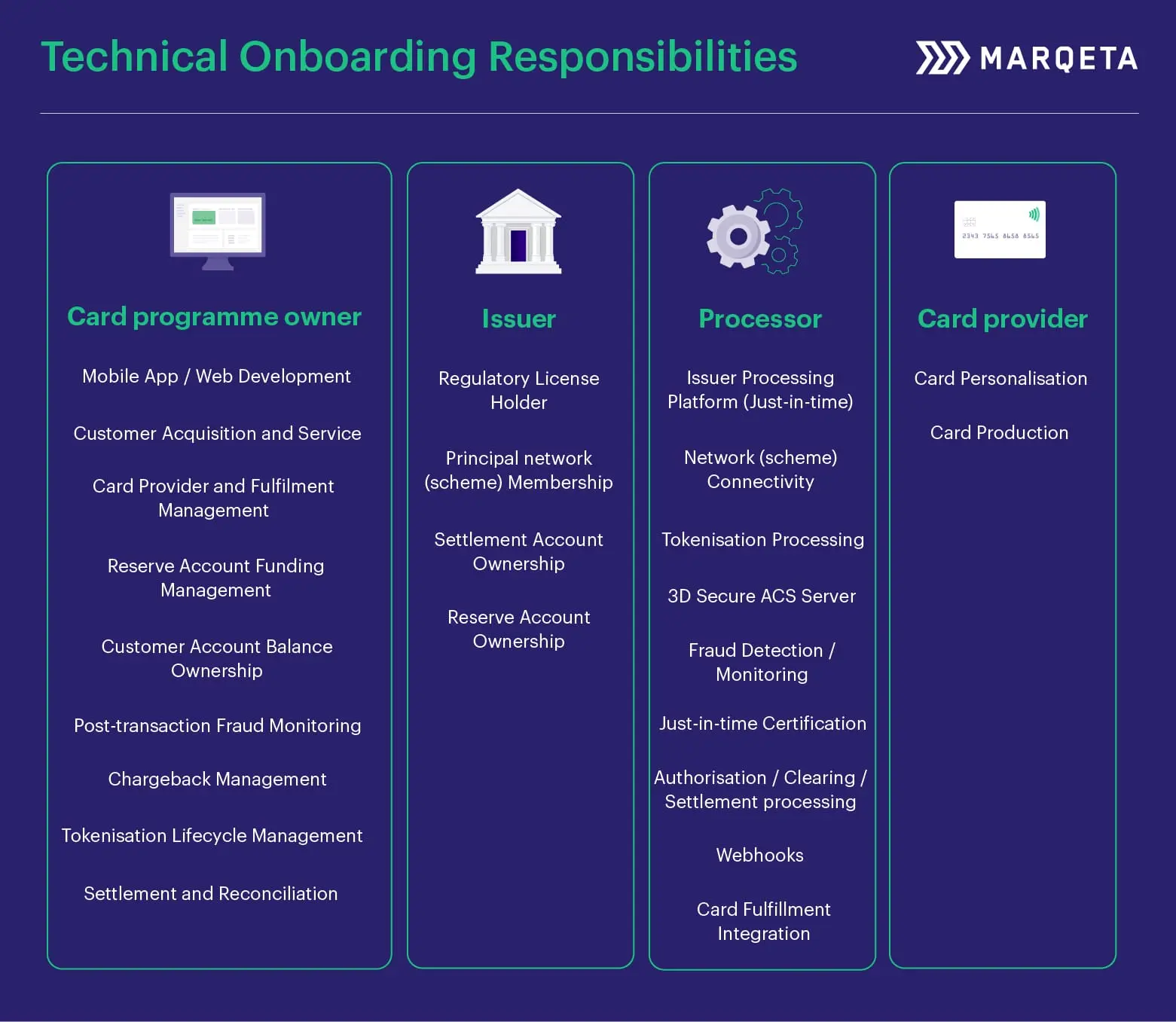

Technical onboarding responsibilities

Every card programme has four necessary components. The entity hosting the card programme, the issuing bank licensed with the card networks, the processor integrated and certified with the card networks, and a card provider, also certified by the card networks. Together, these components form the required capabilities that allow card programmes to issue cards to their customers.

Worth knowing

In the link here you’ll find words of advice from our partner Novus World on launching a card programme and the process they undertook to evaluate and secure the right partners

Martin Magnone, CEO & Co-Founder of Tymit, offers this advice:

- Users expect the best from day one. Cardholders are extremely sophisticated and expect access to advanced features and frictionless services from day one. The moment they onboard, they’ll demand advanced payment options, Apple Pay and Google Pay, rich data, aggregation and more.

- The big fintechs keep raising the bar. The first wave of card-based fintechs, like Monzo and Revolut, built their features over years, but these features are now just the price of admission. Your offer will be constantly compared to theirs, even as they continue raising the bar with release after release.

- Find a processor that can work quickly. Look carefully at their capabilities and make sure they can provide the features you need quickly and cost-effectively. Check their infrastructure supports continuous innovation, because regularly creating value for customers in new ways is fast becoming business critical.

Continue reading

Product

Legal

Location

© 2026 Marqeta, Inc. 180 Grand Avenue, 6th Floor, Oakland, CA 94612