We sat down with our customer Twisto to ask them some questions…

What was the inspiration behind Twisto’s proposition?

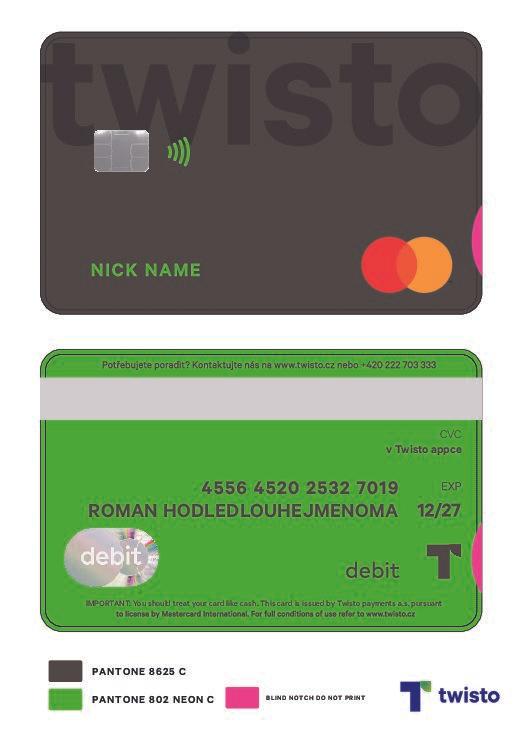

Twisto was originally created as an online payment platform providing a “Buy now. Pay later” service to merchants and customers. The ambition was to change the way people pay online in the Central and Eastern European (CEE) region, which is dominated by cash-on-delivery. We’ve continued to evolve the product and have begun expanding to offline payments, in order to provide the benefit of deferred payments to daily expenses. Today, customers can pay with one-click online, pay bills and invoices with a photo (Twisto Snap), enjoy contactless/mobile payments, and offline payments. This is all thanks to our sleek mobile app and payment card.

How would you describe Twisto’s mission?

Our motto is ‘live your way, pay your way’. Our app and card proposition give customers the choice and freedom to pay for daily purchases and decide if they want to pay now, later or in instalments for larger purchases. It’s free for up to 45 days, after which we apply a fair and transparent fee.

Your recent launch in Poland has been extremely well received – what have been the contributing factors leading to this success?

Our first months in Poland confirmed the huge appetite amongst customers for a daily payments alternative in CEE markets. Polish people are very open to innovation and our USP fits very well between a bank offering and some of the local FinTech solutions. In total, we’ve had more than 150k app sign-ups since mid-October and at least a third of these are fully verified and have been supplied with a card.

You are also active in Romania and Czech. What are the differences between these markets and Poland?

Twisto will be expanding to Romania in Q2 of this year. Romania is a very dynamic and growing market with customers who are open to innovation and Fintech propositions. Customers are open to credit and smart management of their finances in a convenient way, and this is precisely what Twisto can offer – daily payments supported by a mobile app with the ability to pay now, later, or in instalments.

Romania is very similar to the Czech Republic and Poland in many areas – the CEE region has lots in common and customers’ expectations are similar. Adding Romania will allow us to serve more than 50 million customers amongst a target audience of 18-45-year-olds.

What do you see as your biggest challenges in the journey ahead?

We love challenges at Twisto, as they fuel the way we think about the business, our product, and what we do. The world is changing at a rapid pace, things are evolving as we speak in terms of economics, regulations, employment relations, and especially customer needs – so the biggest challenge is to keep up and be relevant to customers in what we do.

What are your plans/ambitions for where you want to take Twisto in the next couple of years?

Our goal is to have two million active Twisto app and card users across a number of countries in Europe. Our customers will shift the majority of their monthly payments to the Twisto app and take advantage of the flexible payment options Twisto provides: pay now with your own money, pay later in 45 days, or pay in instalments as you need over time. Our average customer makes 14 transactions per month, which is well above the bank average, and the majority of our customers are active each month. We’re confident of becoming a leading FinTech in Europe loved by customers and recognised by investors and the market.

Thanks for taking the time to talk to us Twisto, we wish you continued success from everyone at Marqeta.