Introducing RiskControl

Risk management tools purpose-built for card issuers

Accelerate your growth while balancing risk and compliance considerations throughout the cardholder journey.

Grow your card program with confidence

Sophisticated risk tools

Purpose-built tools for mitigating risk across the cardholder journey, improving the customer experience, and delighting risk operations teams.

Flexible control from day one

Empower your team to customize controls around your evolving business needs and card program objectives.

Revenue retention

Help protect against lost revenue to fraud and realize a stronger return on your card program with a suite of tools that drives a focus on growth.

RiskControl is designed to manage risk and compliance across the entire cardholder lifecycle

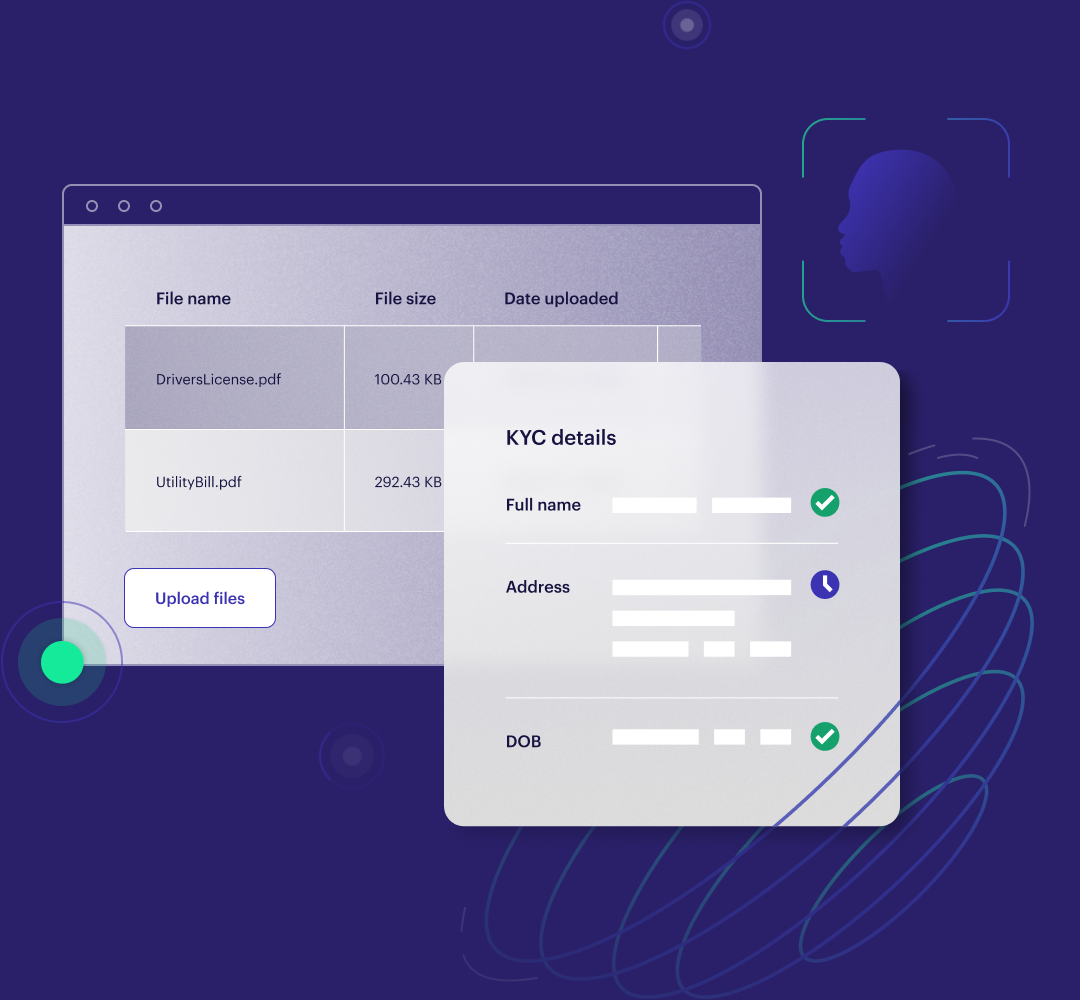

Know Your Customer (KYC)

Verify identities and help protect your card program from the start

Confidently onboard consumers and businesses at scale by swiftly verifying identities and reducing friction for legitimate customers, while helping to block fraudsters.

Improve detection rates, remove complexity for risk operations teams, and meet compliance needs all within a streamlined experience.

Real-Time Decisioning

Fine-tuned controls for each transaction. Purpose-built for card issuers.

Develop, test, and execute highly-customizable rules from hundreds of data attributes, including card network risk scores, on every card transaction.

Improve the cardholder experience by blocking transactions that may be fraudulent, while minimizing false positives.

3D Secure (3DS)

Authenticate cardholders and authorize transactions on a unified platform

Build tailored authentication experiences that mitigate card-not-present fraud while minimizing unnecessary friction or cardholder dropoff.

Retain control over the cardholder experience by leveraging your own business logic and data, and setting your own dynamic rules.

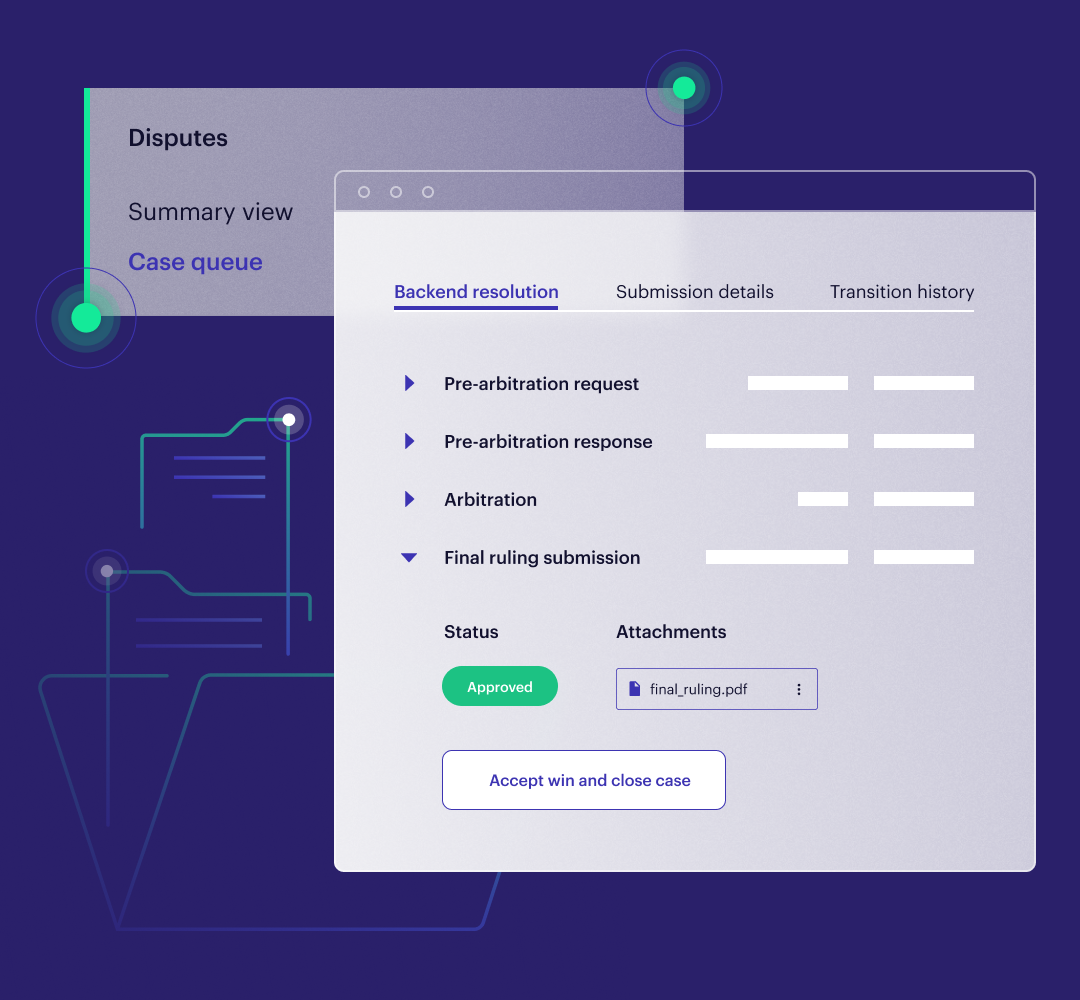

Disputes

Resolve disputes and chargebacks with efficient, streamlined workflows

Speed-up resolution time and improve your cardholder experience by creating and submitting disputes to the card networks through APIs.

Increase transparency through the disputes lifecycle with a streamlined process for risk operations teams to review and manage active disputes.

Michael Smida,CEO at Twisto

Michael Smida,CEO at TwistoDiscover more insights

Stay up to date with the latest industry trends, expert discussions, and educational resources.

Discover more insights

Stay up to date with the latest industry trends, expert discussions, and educational resources.

Solutions

Features

Company

Location

© 2026 Marqeta, Inc. 180 Grand Avenue, 6th Floor, Oakland, CA 94612