Whether it’s achieving greater control over card programmes or designing an ambitious roadmap for global market penetration, Marqeta’s Director of Solutions Engineering Nick Holt is tasked with helping our partners meet their growth objectives. In the past 12 months he’s worked with banks, financial institutions, and fintechs. Here’s what he learnt:

Why the right tech matters

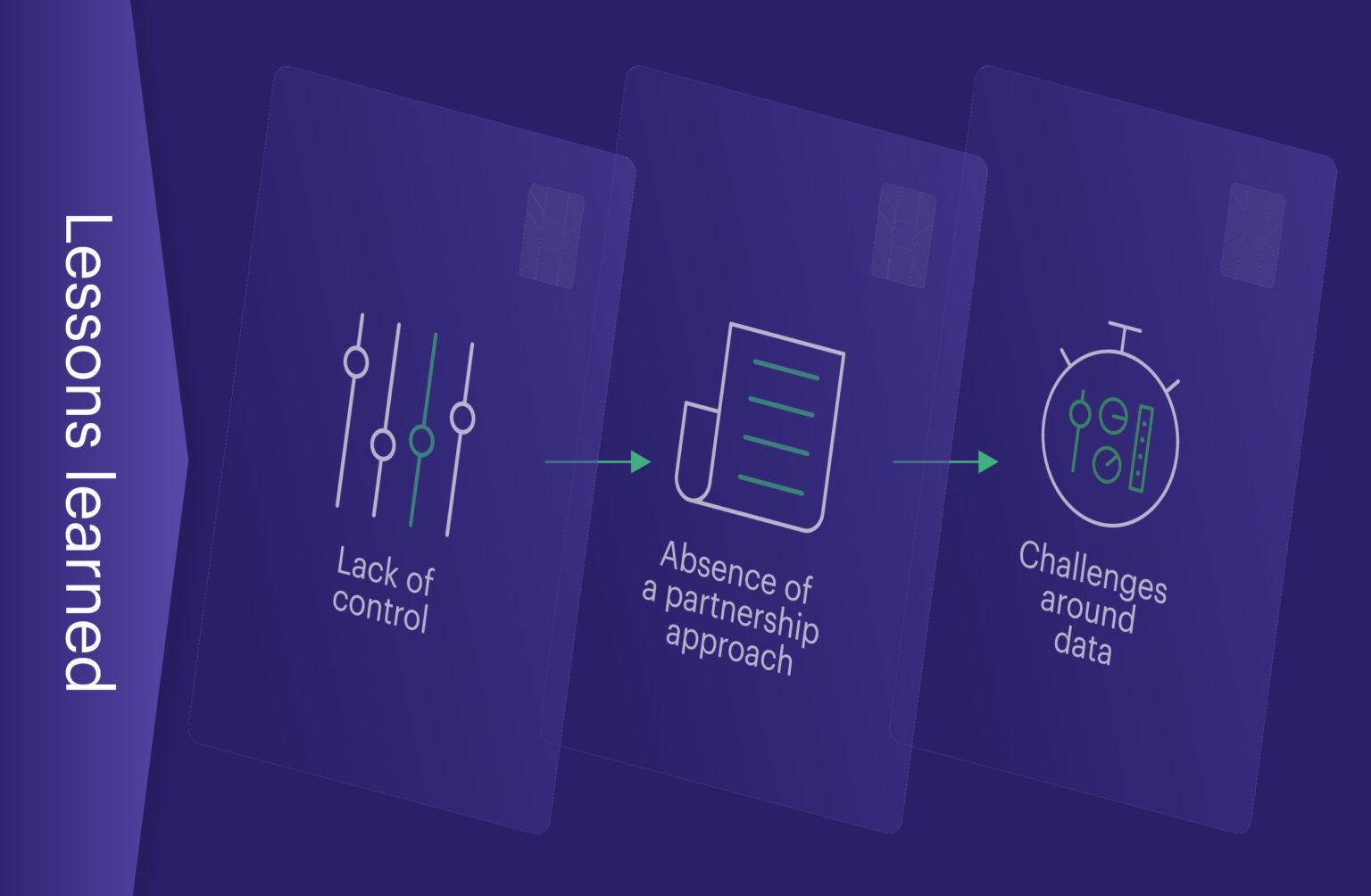

Perhaps the biggest threat to a card programme’s success, in my opinion, is the use of the wrong technology. At a headline level, not only does it hamper the business case and your ambitions, but it can also significantly set back launch timeframes. When I refer to programmes using the wrong tech, in my experience, there are a number of common pitfalls.

The first is a lack of control. Yes, it’s relatively straightforward to get set up with the processor that does the job and keeps the lights on, but problems tend to begin when you want to change or add anything. It can be slow, expensive, and responses are sometimes not conducive to payment product innovation.

The second issue is the absence of a partnership approach. Fast-evolving, dynamic card programmes can find their ambitions frustrated when changes have to be made via a form. You fill out the form and wait — for the resource, approval, and then an invoice. Again, this approach slows changes, may prevent the addition of different currencies, and generally prohibits agility. There’s nothing more energy-sapping for an innovator than having to stick to a disempowering, traditional, rigid process.

Finally, there can be challenges around data. A common problem is having to wait for a processor to act upon new field definitions only for them to come back to you with an XML file. This isn’t real-time and is difficult to consume. Then there’s overnight batch processing and regular reports, which are all on the processor’s terms rather than the card programme’s.

Launching in multiple geographies

Thanks to increasing levels of ambition amongst card programme owners, more and more fintech businesses want to launch or have the option to launch in multiple jurisdictions and regions. This demonstrates that entrepreneurs are thinking beyond the tech solution and giving sensible consideration to product roadmaps in a global context. It’s absolutely the right thing to do, particularly for B2B card propositions because the interchange is higher in the corporate market than the consumer one. And if you look at France, Germany, Spain, and Switzerland, these large markets are hotbeds of fintech innovation right now.

Additionally, there’s nothing like venturing into new markets for speeding up platform innovation, which often leads to features that prove beneficial to card users in your founding market. However, many perhaps don’t appreciate that launching in a new country isn’t such a straightforward exercise from both time and cost perspectives. One way to simplify the process – to a noticeable degree – is to offer virtual cards, which are easy to spin up and tokenise with a modern card issuing and payment processing platform. There’s a tangible appeal to being able to do this as it can serve so many use cases, such as travel expenditure and overseas business purchases.

The banks get it

We hear much discussion about how banks should approach digital transformation and whether they’re moving fast enough. Our experience in Europe has taught us that digitalisation is a prominent boardroom agenda item which is being actively discussed with a focus on delivering outcomes. The banks absolutely understand the landscape and opportunities that digital offers, particularly how using data more effectively can create personalised, life-enhancing payments experiences. But the fact is, as far as banks are concerned, things work because they have to — and they have done to date. Whilst these organisations may operate long-established systems, I believe it’s wrong to think this all needs to be replaced. New technology, which has to be foolproof and tried and tested, can fit in alongside existing technology frameworks. Our job as innovators is to deliver dependable support and expertise that enables new technology to be woven in seamlessly.

Rather than rip and replace, a smart option is to partner and build. Indeed, we’re finding that a positive, partnership-led approach to innovation is leading to the kind of collaboration that is going to revolutionise retail banking. And, it’s looking very much like established banks may well be about to become the challengers.

What should we expect in the next 12 months?

We’re increasingly seeing smart, tech-savvy partners launching products across Europe, and this is being accelerated by the coronavirus pandemic as companies and consumers rely more and more on digital payments solutions. However, the need for a sound business model and the ability to differentiate have never been more important, as the shocks of the pandemic put business propositions to the test. Additionally, I think we’ll see greater assertiveness from fintechs who want to project their founding values and push for faster change in markets. Survival will depend on the ability to pivot, innovate, and offer card programmes that either deliver personalised, financially-helpful experiences to consumers or cost savings and efficiencies to businesses.