Do you know who your customers are? Increasingly strict financial regulations require companies to verify the identity of every customer who opens an account. For card program managers, the work required to comply with Know Your Customer (KYC) guidelines can be substantial, but compliance has its advantages. While KYC guidelines were originally put in place to prevent money laundering, they can also be helpful for mitigating potential fraud and managing card program risk.

At Marqeta, our mission is to empower developers to build new payment solutions that enable the most innovative products and services. This means minimizing the effort required to comply with financial regulations while maximizing the benefit. Our answer to KYC guidelines is our Know Your Customer APIs for consumers and for businesses. These solutions are designed to automate the cardholder onboarding process and reduce the operational burden on a card program.

A description of customer due diligence requirements can be found in the Federal Register, Vol. 81, No. 91. These requirements are issued by FinCEN, the Financial Crimes Enforcement Network, a bureau of the U.S. Department of the Treasury under the Bank Secrecy Act. The elements of customer due diligence include:

1. Customer identification and verification2. Beneficial ownership identification and verification3. Understanding the nature and purpose of customer relationships to develop a customer risk profile4. Ongoing monitoring for reporting suspicious transactions

Marqeta’s Know Your Customer APIs simplify compliance for consumers and businesses

The complexity involved in creating a card program that ticks all the boxes on customer due diligence while remaining a cost-effective payment solution poses obstacles to payment innovation. Marqeta’s KYC APIs address this by streamlining and simplifying card program manager and cardholder tasks related to compliance.

Marqeta’s KYC APIs work like this:

KYC signup:

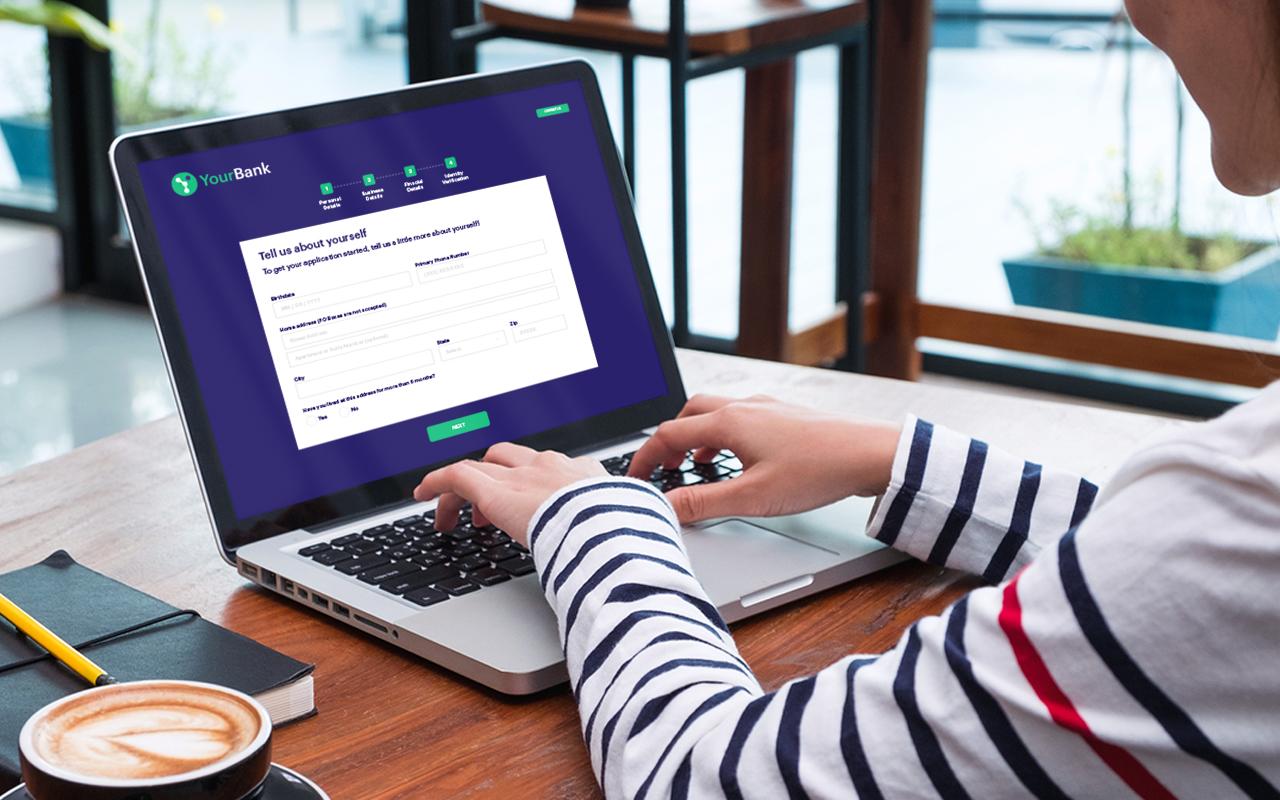

Individuals. If a new cardholder is an individual, they provide personally identifiable information (PII) via an online form as part of the sign-up process. This includes the cardholder’s name, date of birth, address, and a tax identification number such as social security number (SSN). (Please see our KYC API developer guide for more detail.)

Marqeta’s API compares the information provided by the customer with other data sources such as records maintained by a consumer reporting agency or government agencies. Often referred to as electronic identity verification (eIDV), this online process mitigates risk at a level that is equal to and can be superior to traditional KYC processes, which typically consisted of an employee of a bank or other financial services provider visually examining identity documents.

Businesses. If a new cardholder is a business, they provide[e][f] the business’s legal name, address, and tax ID number, as well as personally identifiable information about any beneficial owner(s) and control person(s). (Other information required can be found in our documentation.)

KYC verification:

Results are returned in seconds. If a customer is successfully verified, the user account is unlocked, and the cardholder now has the ability to transact. If the verification process results in questions about the cardholder’s identity, the card program administrator is notified and the user remains inactive.

KYC notification:

The Marqeta API notifies the cardholder of approval and activates the user. If the user is unable to be verified, the Marqeta API provides information on what information could not be validated.

Complying with KYC requirements is challenging for any business, and particularly for startups or innovative card programs that must fight for resources within large enterprises. While organizations can decide to build verification themselves, Marqeta’s KYC APIs offer a streamlined, cost-effective alternative that supports faster time to market. Cardholders benefit from reduced friction, while program administrators have assurance that their KYC process is fully compliant with U.S. regulations. Rather than spend time researching opaque regulations, developers can do what they do best — build great products.

Want to learn more? Please call to chat with one of our card program experts.https://www.marqeta.com/contact-us