While innovation is often medicine, the health care industry often falls behind available technologies. Many health care providers rely on outdated systems and infrastructure for critical functions including billing, communication, and data management. For both providers and patients, the result has often been frustrating inefficiencies and high costs. Thankfully, the well-documented hesitancy for change within health care has created fertile ground for health tech innovators who are now alleviating traditional health care pain points by applying contemporary tools and emerging technologies.

Here are six highly instructive lessons that come directly from startups and established companies within the health care industry. These observations are drawn from primary source literature, including company websites, industry journals, customer stories, earnings calls, news sites, forums, and analyst reports. Alongside streamlined and flexible payment options that benefit consumers and health care businesses alike, innovators are upending many problems endemic to the health care industry including revenue cycles, billing flexibility, and patient access to care and medical professionals.

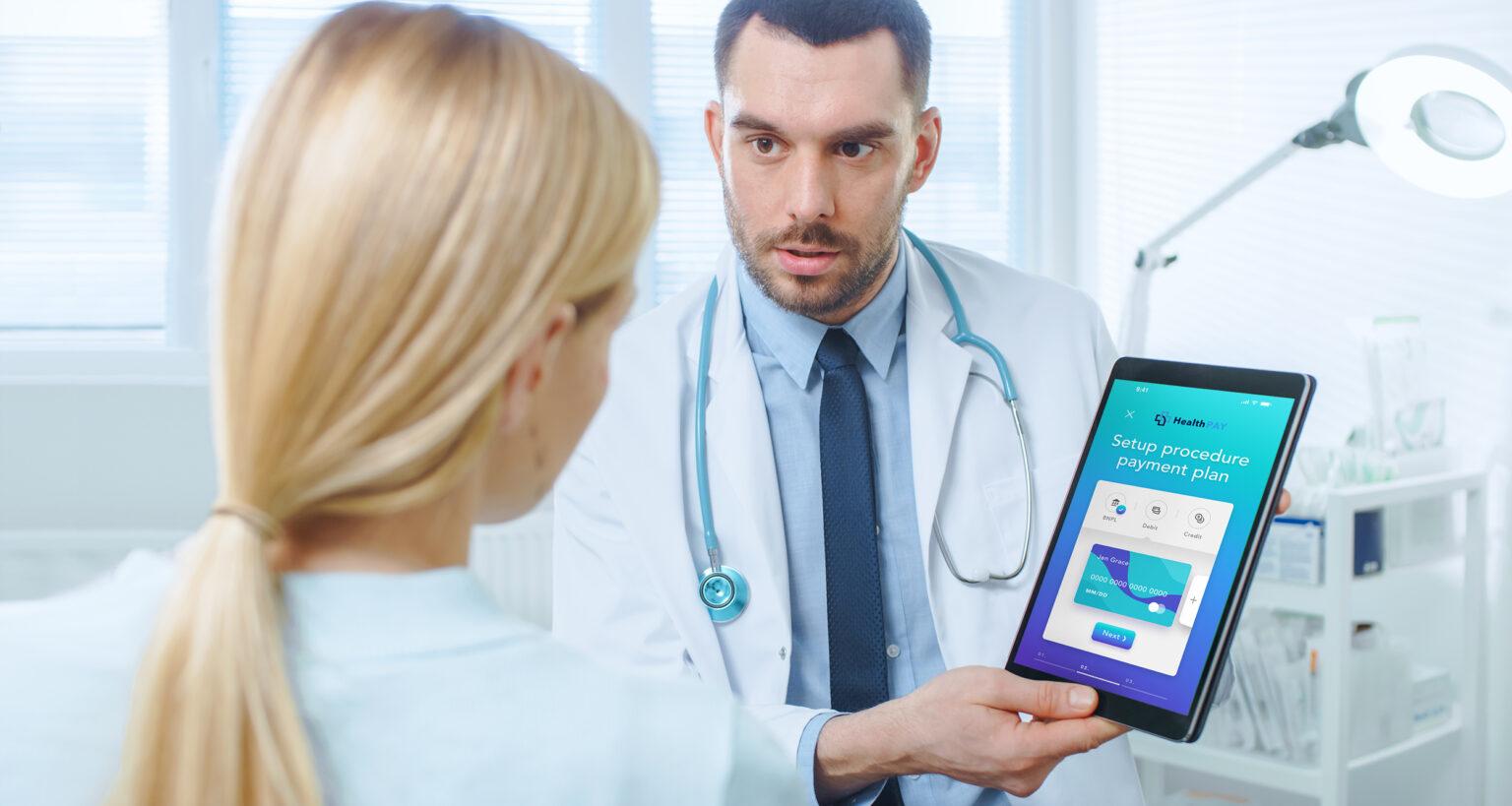

1. Adopting e-commerce success with Buy Now, Pay Later

Americans now have over $140 billion in unpaid health care debts sitting in collections. That’s the largest it’s ever been, despite multiple attempts in the past decade to bring down costs. For tech companies CarePayment, AccessOne, and Walnut, one answer is to apply the principles found within a Buy Now, Pay Later (BNPL) framework.

BNPL emerged within e-commerce as an alternative to layaway programs. Instead of asking a retail store to hold an item that’s paid off in installments before the item can be received, BNPL gives consumers an interest-free loan at the point of sale. The retailer gets paid instantly, while the buyer receives the product immediately. Thanks to this creative payment scheme, buyers can pay the loan off in installments.

CarePayment, AccessOne, and Walnut have leveraged this technology for the health care industry. Each company utilizes modern payment infrastructure to help providers collect payments faster while giving patients access to financial vehicles that reduce billing shock.

Sometimes called “Care Now, Pay Later,” this flexible payment option holds groundbreaking promise, especially for low-income patients. With the option to pay over time, patients can spread out the cost of high medical bills without having to take on additional debt to do so, breaking payments up into smaller pieces, and ultimately resulting in fewer unpaid medical bills going into debt collection. Importantly, because this process occurs at the point of sale and without credit checks, it creates a more equitable option for paying medical bills.

2. Virtual care becomes a cost-saving norm

Although once the standard form of patient care, house calls are on the decline. Nevertheless, the combination of a rapidly aging population and a global pandemic have both made it necessary for patients and medical professionals to connect outside of a hospital setting. Virtual home visits are easier than ever thanks to companies such as Grand Rounds, Doctor on Demand, TytoCare, and Crossover Health. These innovators are utilizing app-based digital technologies to easily connect patients with doctors. Virtual visits effectively disregard physical boundaries and distances and avoid health risks associated with in-person hospital visits.

This practice falls more broadly within the realm of telehealth. Prior to the global COVID-19 pandemic, telehealth was limited in availability, scope, and interest. During the height of the pandemic in 2020, however, it became one of the primary methods for doctors and patients to connect. As hospitals shut down, telehealth services increased to fill the gap, resulting in a nearly 3,000% increase in telehealth claims among Medicare beneficiaries.

Trends suggest that telehealth may be here to stay. The practice can produce significant cost savings for hospitals and other care facilities by increasing productivity, reducing ambulatory care, streamlining alternate payment methods (such as BNPL), and opening up telementoring as an available outpatient format.

3. Mental health gains important recognition alongside physical health

Despite its exceptional prevalence, mental health continues to receive less attention due to cultural stigmas surrounding both diseases and treatment. According to the National Institute of Mental Health (NAMI), over 51 million Americans have at least one mental illness of any kind. The stigma around mental health runs deep, especially within historically marginalized communities of color. Consequently, this issue is seen as a crisis by health professionals.

Until recently, the biggest barrier to reducing individual struggles with mental health was access to services. That’s changing thanks to innovative companies establishing app-based infrastructure that can discreetly connect individuals with mental health professionals. Companies such as Lyra and Ginger emphasize on-demand access to mental health services, allowing users to schedule appointments and remote chats with psychiatrists and counselors, or connect with a health care provider 24/7 via text messages.

Attention is also being given to marginalized communities of color, for whom access to mental health services has been historically lacking. The Confess Project, for example, seeks to make barbershops mental health hubs for Black men and boys, bridging the gap between cultural safe spaces and access to mental health services.

4. Make billing and payments as frictionless as possible

As noted earlier, billing is a longstanding issue within the health care industry. Patients want not only more transparency in the billing process, but also easier ways to pay. The vast majority of the friction is on the side of health care and health insurance providers, both of which still largely rely on legacy technologies and billing methods instead of available digital tools for billing patients.

This problem is highlighted through InstaMed’s 2020 Trends in Health care Payments Annual Report, which finds that:

* 85% of consumers want to pay bills electronically* 89% of consumers want to pay health insurance premiums electronically* 58% of consumers would install an app for medical bill payment* 82% of consumers want a single payment interface for all medical payments

For its part, Cedar is working to make payments easier in all of these ways, and more. The company has partnered with numerous health care providers, including Allina Health, Hartford Healthcare, Summit Health, West Tennessee Healthcare, and many more to help modernize the patient financial services experience. That enhanced experience includes digital billing and payments, as well as adding BNPL options at the point of bill payment. According to Cedar, providers using modern patient billing methods can see at least a 30% increase in patient collections, which is a boon for both patients and providers.

5. Revenue cycle efficiency using AI

Legacy billing processes can lead to high medical debt for patients, but can also harm providers’ bottom line. Slow revenue cycles can leave providers sitting on millions of dollars in uncollected payments, which can cause significant disruptions in service. Traditionally, revenue cycle management relies heavily on manual processing across multiple steps, from setting appointments all the way through collecting payments from third-party insurers. This process can take over 30 days before any payments are received.

Improving revenue cycles provides better liquidity for providers, making it easier to eliminate bad debt, improve infrastructure, and offer better services to patients. Several health tech innovators, such as Change Healthcare, are working to apply artificial intelligence to the revenue cycle. Artificial intelligence (AI) is applied to all steps of the revenue cycle with an emphasis on the largest bottlenecks such as patient prior authorization, which can take up to two business days each week to complete manually. Use of machine learning in billing and auditing can cut waste and increase revenue while optimizing the patient experience.

6. Creating opportunities for niche health care needs

Equity is a significant concern in modern health care. Despite the expansion of care access through the American Care Act (ACA), coverage of many types of niche services remains elusive in most health care plans. Mental health coverage is now required under most plans, but the extent of that coverage is still lacking. Also, some health needs particularly to certain demographics are less likely to be available under an affordable insurance plan, primarily due to how niche those services may be.

Several startups are looking to bring these services out of the shadows. Rory, for example, is hoping to capture an untapped market for health services many women want, but that are not commonly available through providers, such as skin care and sexual health. Meanwhile, Hurdle has designed a service to help battle cultural stigmas around mental health within minority communities. The company’s app-based service offers a unique algorithm that matches individuals with therapists that are best suited to offer aid.

From billing modernization with BNPL to expanding on the availability of care types, health tech innovators are laser-focused on leveraging emerging technologies to antiquated systems or outdated health care models. The end-user experience plays a pivotal role in almost every use case.

Health care innovators are seeking to solve the frustration that end users (patients) have with aging health care systems. In doing so, they’ve found that cross-industry partnerships are the easiest route for faster time to market and rapid scaling. Also, streamlining payments with virtual cards powered by Marqeta’s modern card issuing software can help health care companies give both patients and providers a superior experience while minimizing the financial stressors that are too often associated with the industry.