With the rise of digital car and furniture retailers across Europe, it’s clear that an increasing number of people trust the internet when it comes to purchasing life’s big ticket items. And this shift to more digital shopping is almost certainly being driven by a wide range of factors. These include the Covid-19 restrictions placed on many bricks and mortar retailers during the past 18 months, along with advances in technology that have allowed people to visualise a piece of furniture and moneyback guarantees in car sales.

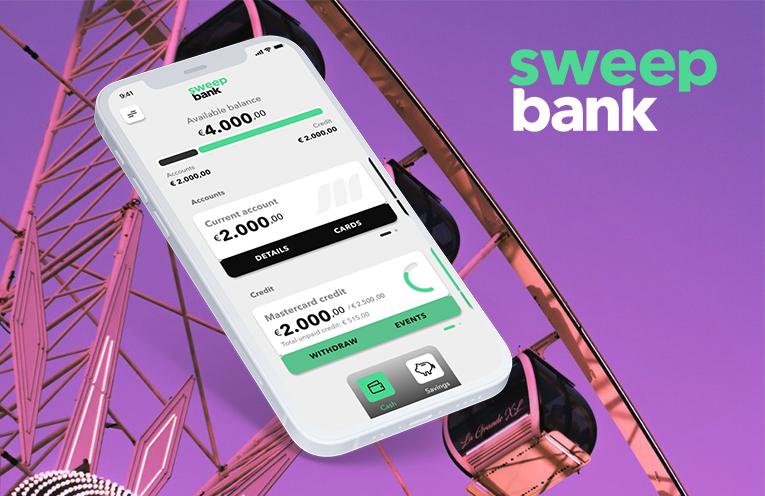

Digital banks that understand how to personalise products and services for people who shop the internet are likely to be playing a role too. Take Sweep Bank, for example. Growing quickly in Finland and Latvia, this challenger brand is catering to tech savvy young adults who need a financial partner capable of supporting their investment aspirations, whether that be for cars or couches. Marqeta met up with Julie Chatterjee, Sweep Bank’s Chief Commercial Officer and deputy CEO, to find out a bit more about how they’re responding to a changing retail landscape.

Can you tell us about the Sweep Bank journey so far?

“Sweep Bank is the creation of Multitude subsidiary Ferratum Bank p.l.c. The group’s background is in digital first loans and credit and we’re active in around 20 countries across Europe, so we’ve built up a lot of experience in this area. We’ve also conducted detailed research into consumer demographics and it’s become clear to us that there’s a demand for a new kind of banking among young adults and parents. Members of this audience are tech savvy and see credit as a way to enhance their lives and help them buy the things they need. It was against this background that Sweep Bank was born.”

What are Sweep Bank’s key features and how do you differentiate from existing providers?

“We describe ourselves as a ‘smartbank’ that is being designed by our users, as we proactively encourage our customers to inform the product roadmap. We offer a current account with a debit card and savings tools, in addition to prime lending up to €30,000. We also have a Mastercard credit card in the pipeline. This functionality is all available through the Sweep Bank app for a completely digital banking experience. And while you can do all the things you can do with a normal bank account, the emphasis is very much on our lending proposition, as this is our greatest area of expertise and where we can add the most value to our customers.

“We’re also geared towards a very specific demographic, which we know is not having its needs satisfied by legacy propositions and is open to a different way of doing things. This focus on a niche audience allows us to excel in serving its needs.”

How do you see your technology evolving over time?

“We’ve built a unified tech stack for our application and this enables us to offer a solid onboarding process via iOS and Android platforms. There is going to be greater reliance on machine learning and automation as consumer expectations for real-time, instant loan products and deposits continue to grow. We’re also looking at working with third parties, connecting via APIs in a standardised way, to offer our customers a range of complementary services within the app. One of the benefits we offer to third parties is that there’s the possibility that as we expand across new territories we take them with us too.

What do you think is going to change in banking in the next five to 10 years?

“I truly believe that the future of banking lies with platforms, and consumers will prioritise a totally digital asset-oriented experience. Even the more difficult products like mortgages will be digitalised and embedded, making them much more accessible than they currently are. It will be very different from today’s experience. The main point from Sweep Bank’s perspective is how we fulfil that need for credit for the widest possible range of large and small products. We’ll see greater convenience alongside increased options and more personalised ways to pay – and this is going to become essential as people continue to lead more digital lives.”

Further information about Sweep Bank can be found here.

Marqeta regularly engages with companies in the payments ecosystem to learn more about the new approaches they are bringing to solving challenges related to financial services and money movement in general.

Learn more from our interviews with: