Boosted by the rise of the platform economy, gig work is now a component of virtually every sector – from manufacturing and construction to hair and beauty and technology. It’s no longer the sole preserve of the bicycle-borne youth with your takeaway on their back.

In fact, across Europe it is estimated that more than 35 million people work in the gig economy.

For some it’s an existence that brings convenience and flexibility, while for others it means a precarious financial life, with cash often running out before the end of the month.

But what if the same spirit of innovation that delivered the platform economy was also applied to helping zero hours contractors?

Well, it very much is thanks to ‘accelerated wage access’, which is not only being offered by specialist platforms but also represents a tremendous opportunity for employers and B2B expense management fintechs looking to bolster their product range.

A real-time pay solution to support workers across the economy

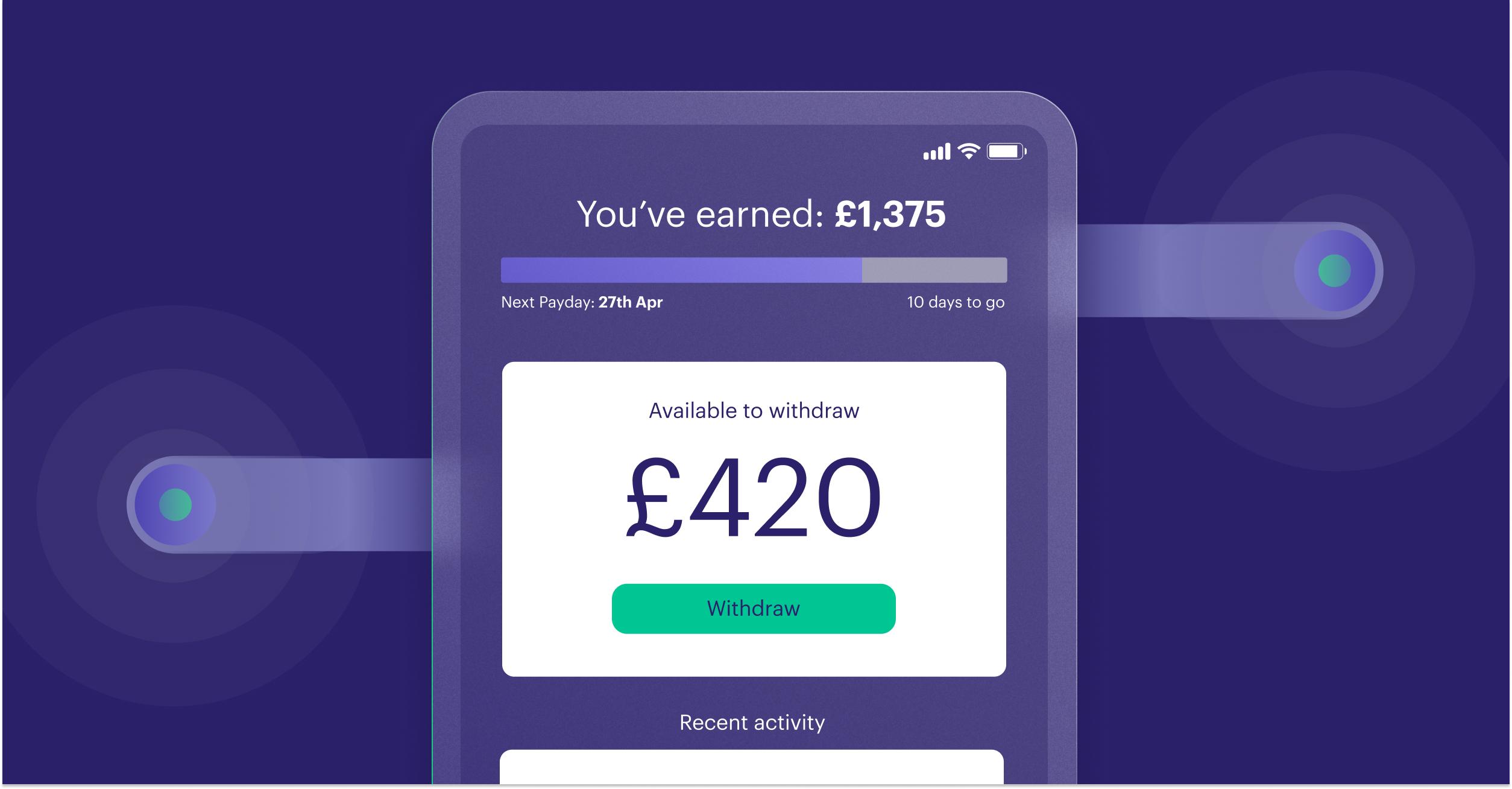

Accelerated wage access allows valued staff to draw down cash they’ve earnt in real time – without having to wait for payday. For workers who live from month to month this can be a lifeline.

Research by Visa has shown that 84% of workers wanted earned wage access between pay periods and that worries about personal finance were affecting the health of 68% of employees.

Interestingly, it’s not just gig economy workers who can benefit from a salary advance, also described as early wage access, salary advance, or employer salary advance schemes. Since the 1960s, it has become the norm to pay people monthly rather than weekly.

This has undoubtedly created pressures on many household budgets. So in effect, earned wage access is also great news for many people who would rather receive their salary more frequently.

How accelerated wage access is offered

Crucially, it’s essential to clarify that earned wage access is not a loan, so shouldn’t be compared with payday lending or any other type of credit.

Salary advance providers usually charge a flat fee for each withdrawal. These fees can be subsidised by employers too, so the worker experiences no loss of income.

The UK financial regulator, the Financial Conduct Authority, says employer salary advance schemes have benefits, but cautions that both employers and employees should be aware of risks and take measures to ensure healthy use of advances.

Such steps include providing notifications when there has been a build-up of charges and offering advice and guidance about problematic debt.

Considerations for offering or building an accelerated wage access solution

So, having weighed up the pros and cons, employers that have decided to offer accelerated wage access will be pleased to learn they have a number of options.

Firstly, they can go with a dependable third-party provider who offers a tried and tested solution that works in a range of use cases.

The second option involves building a tailored proposition, which is ‘managed by’ a modern issuer processor platform like Marqeta.

This approach enables programmable payments and open payment flows, giving the employer full visibility of transactions.

Using open APIs, employers can quickly build an earned wage access card programme, available for employees to use in a matter of weeks in the form of a physical or virtual payment card. Conveniently, digital cards can be ‘pushed’ directly into smartphone wallets.

The third route is to build an accelerated wage access card programme from scratch, in house. Without specialist developer skills and technology, this is the most challenging option.

It requires establishing relationships with issuing banks, card networks and processors, and developing the expertise necessary to comply with regulations.

An end-to-end build requires a greater investment than working with a modern card issuer processor, but may make sense for some companies.

Thinking ahead about salary advances

As cost of living challenges continue to remain a feature of life, accelerated wage access solutions could become increasingly common as their advantages and the various paths to launch them become more widely known.

Indeed, companies that offer salary advances could find improvements not just in employee well-being but recruitment and loyalty too.

With that in mind, it’s perhaps worth returning to Visa’s research, which found that 89% of people surveyed said they would work longer for a company that offered earned wage access and 79% would switch to a business where such schemes were available.