Launching existing products in new markets (“market development”) is becoming a new frontier for financial services businesses. And while the internationalization opportunity is huge, the challenges of identifying addressable markets, striking the right balance between global and local and navigating the complexities of working with vendors and regulators can make doing so both tricky and difficult.

There are incredible opportunities and immense risks associated with global expansion in the financial services industry, which is why we’ve written a whole white paper about it, which you can download here. We’ve extracted some of the high-level highlights below, but for all the details and insights, be sure to read the full document.

The 4 drivers for global expansions in financial services

Let’s examine the background to this trend, and the extent to which expanding cross-border has become easier in recent years.

The digital payment opportunity

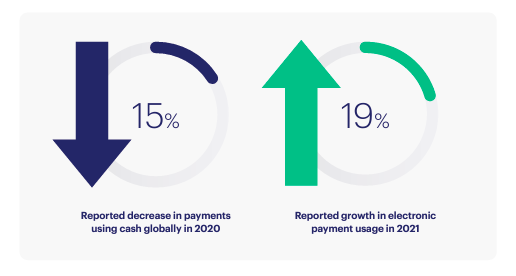

The COVID pandemic accelerated the shift towards digital payments, with a 15% decline in cash usage globally in 2020. Overall electronic payment transactions globally grew by 19% in 2021, attributable mostly to the rise in real-time and account-to-account payments.

Source: Marqeta’s Internationalization White Paper

The shift to digital commerce and banking

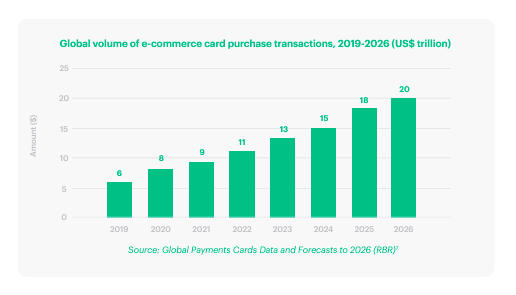

E-commerce has experienced significant growth, with a record $7.7 trillion spent online using payment cards in 2020.

Global annual spending on payment cards is expected to grow at an average of 18% between 2020 and 2026.

The mobile revolution

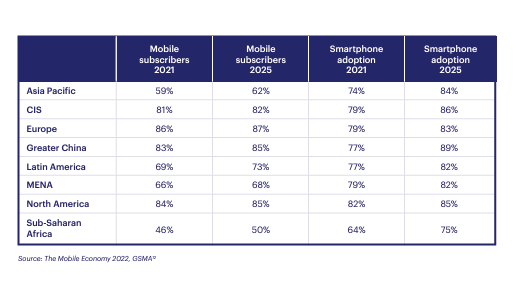

Mobile phones have become ubiquitous, and 5.3 billion people subscribed to mobile services by the end of 2021.

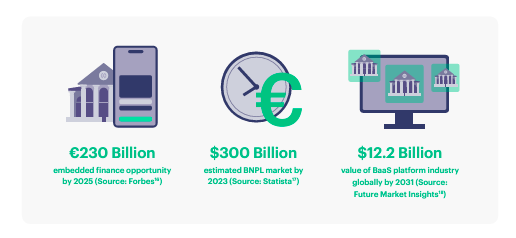

Any company can offer financial services

The digitization of payments, banking, and commerce has created opportunities for embedded finance, BNPL, earned wage access, working capital solutions, remittance, banking-as-a-service, RegTech, and digital identity.

APIs, Open Banking interfaces and various integrated, as-a-service propositions are making it easier for any company to launch and scale financial services. It can be quicker and cheaper, too, when companies don’t have to invest in new infrastructure, or hire and train staff.

Source: Marqeta’s Internationalization White Paper

With all this now in mind, let’s focus on one company’s successful internationalization effort in particular.

Internationalization case study highlight: Capital on Tap

With an increasing focus on niche propositions, where scale is needed to make the business model work, Capital on Tap designs its products around the needs of small businesses, launching a credit card in the UK in 2012. “For us, focusing on a particular area of the market, it’s been an interesting opportunity to look internationally to support small businesses that we think have been under-served,” explained Zoe Newman, Director of Operations, Capital on Tap.

As the team found success and achieved product-market fit in the UK, they recognized the potential for growth by expanding into new markets. Around 2020, they started exploring potential markets, considering factors like regulatory requirements, market size and the feasibility of underwriting and credit assessment for businesses.

In 2021, Capital on Tap set its sights across the pond and shifted its focus to the United States. The decision to expand to the U.S. was primarily driven by the market size and their bet that small business owners were continuing to be underserved by legacy players. Language barriers were not an obstacle in this case, and leveraging existing vendors like Marqeta allowed them to quickly scale and launch the product.

“We wanted to maintain the core functionality of the product and avoid extensive development work and localization efforts. So, in choosing our target market, we aimed for minimal local customization to ensure agile business operations.”

– Zoe Newman, US Managing Director, Capital on Tap

Once Capital on Tap identified the U.S. as their top choice for expansion, they focused on two main areas of implementation— “how do we find customers and how do we ensure we understand local legal and regulatory requirements?”

First, in finding new customers, they spent a lot of time tailoring their UK acquisition strategies for the American market. And while their fundamental acquisition strategy is similar to what they do in the UK, where they deployed time and mind share were quite different in the U.S. business.

Second, understanding the legal and regulatory implications of a new market was crucial. Finding a great local legal counsel that could help them navigate the alphabet soup of American regulations was a great unlock for the business.

Lessons Learned & Key Takeaways

First, never underestimate how hard it will be. This sounds obvious, but adding a new geography adds complexity to every part of a business. Every new initiative and new product needs to be thought about specifically for your second market. New compliance requirements, new marketing requirements, new customer service requirements—it’s all hard and complicated. This can slow the speed of everything down in your business. While you might think everything is “basically the same” it’s easy to underestimate the complexity.

Second, you should treat each new market as requiring you to achieve product-market fit for the first time. Rather than assuming everything will work as it does in your home market, go back to first principles and treat this as a “second founding” for your business.

For example, Capital on Tap started by going after all the marketing channels they use in the UK all at once. Looking back, they admit that they should have taken a more narrow approach and focused on one channel at a time so that they didn’t spread themselves too thin. “So my advice to founders looking to expand to a new market,” said Newman, “is to go slow at first, to go fast later.”

Marqeta has deep expertise in multiple geographies, and the advice above comes straight from our customers and partners who have all leveraged Marqeta to expand into new geographies. There are even more examples in the full whitepaper. Download it now to read more.

Take it global: Enabling seamless expansion

Before jumping in with both feet, be sure to get to know the drivers, challenges and strategies for international expansion in the fintech industry.

- Fintech companies aim to increase their user base, usage, and volume by expanding internationally.

- Niche propositions and targeting underserved markets can be a successful strategy for fintech growth.

- Displacing cash and digitizing transactions presents a huge opportunity for fintech companies.

- Market research and understanding customer needs are crucial for qualifying the international market opportunity.

- Determining the operating model, such as applying for licenses or partnering with local firms, is an important step in international expansion.

- Striking the right balance between a global template and local customization is essential for success.

- Regulatory requirements and compliance play a significant role in international expansion.

- It is important to learn from the experiences of previous successful international expansions but be prepared to adapt and iterate.

The global embedded finance opportunity is estimated to reach $7 trillion in the US alone. The major factors that can catalyze international success include obtaining a true understanding of customer needs, operating according to core values, adapting products and services to new markets, engaging with local regulators and partners, ensuring compliance from the start, and effective communication with stakeholders. Patience is also important, as the payback on expansion may not be instant.

So, ready to deepen your understanding of internationalization and crack the world wide open for your business? Then it’s time for you to read the full whitepaper.