The global pandemic has forced millions of Americans to change their behaviors — how they interact, how they manage their money, and how they make payments. In September 2020, in partnership with Propeller Insights, Marqeta conducted a survey of 2,006 Americans to find out how this last year has impacted consumer buying habits and the payments landscape as a whole.

Over the next few months, we will be releasing our findings in our four-part “2020 State of Payments” series, with insights into how COVID-19 has accelerated the shift towards digital payments and changed the way we shop, possibly for good.

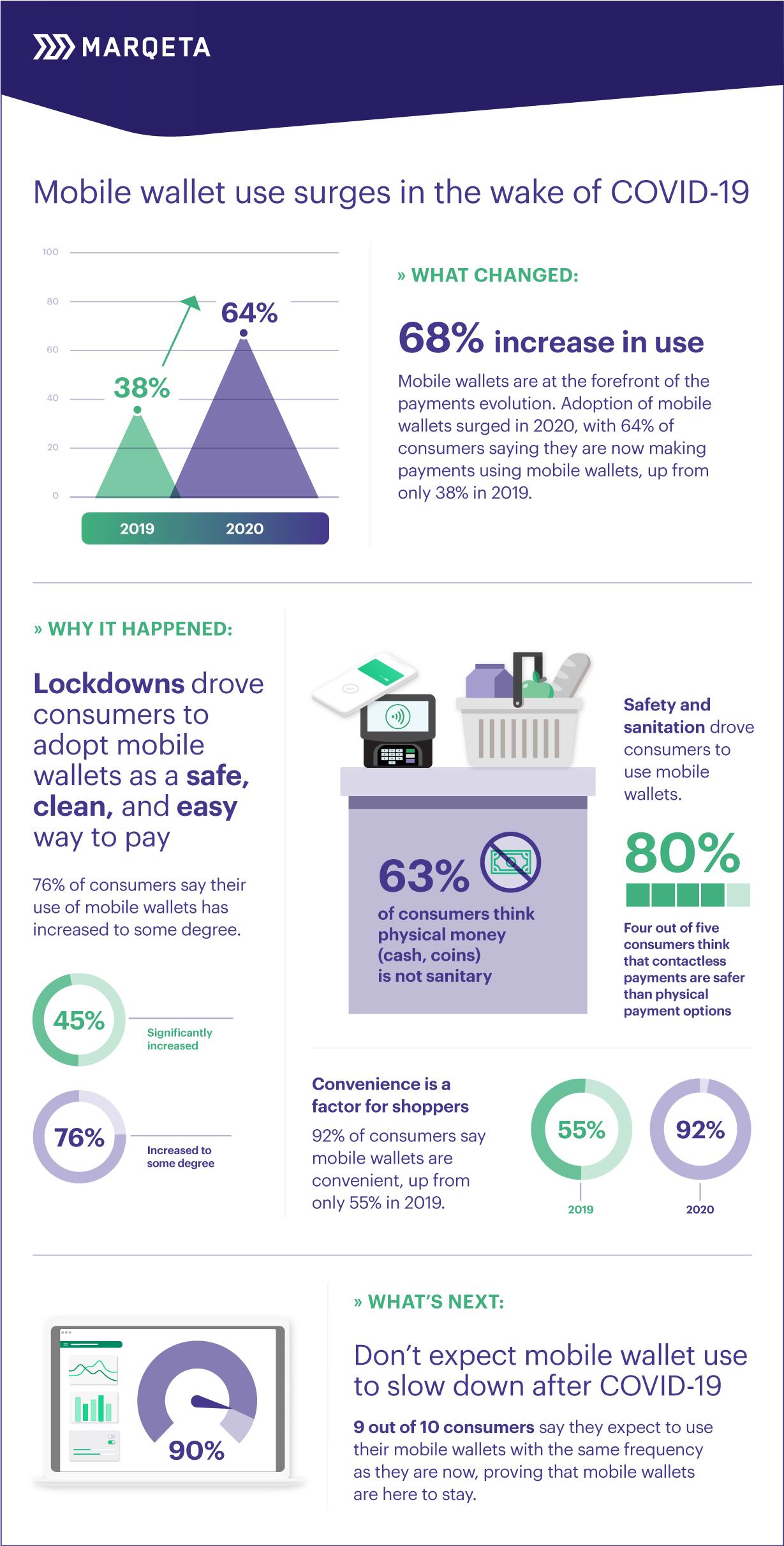

Mobile wallets are at the forefront of the evolution of payments

Mobile wallets have been called the “next big thing” in payments since Apple Pay was introduced in 2014. Consumer and merchant adoption rates of digital wallets told a slightly different story, however, with adoption growing steadily, but falling short of the hype. This all changed when the world changed in 2020. Mobile wallet adoption has surged in the last year, becoming one of the preferred consumer payment methods throughout the pandemic.

According to our survey, 64% of consumers said they now use their mobile wallets to make payments, up from 38% in the same survey in 2019. More than three-quarters of consumers also automatically add their credit or debit cards to their wallets when they first receive them, showing how mobile wallets have now become a more routine part of consumers’ everyday lives.

As consumers become more open to digital payment options during the pandemic, they’ve also come around to the convenience of mobile wallets. A massive 92% of consumers said they find mobile wallets to be an easy, convenient way to pay, up from only 55% who said the same in 2019.

This increase in adoption hasn’t been completely driven by younger generations either:

- 80% of people ages 35-50 years old now use their mobile wallet, up from 39% in 2019.

- 45% percent of ages 51-64 years old use mobile wallets, up from only 22% in 2019.

- 67% of people ages 26-34 are now using mobile wallets, up from 51% in 2019.

COVID-19 drives consumers to safer, more convenient ways to pay

Since COVID-19 locked the country down in March 2020, consumers have turned to digital wallets to make payments directly from their mobile devices. Seventy-six percent of consumers have increased their mobile wallet use to some degree since lockdowns began and 43% have significantly increased their use.

Consumers today are looking for safe payment options, with the contactless nature of mobile wallets putting people at ease at the point of sale:

- 63% of consumers do not think physical money (cash or card) is sanitary.

- 80% said contactless payments are safer than physical payment options to some degree.

The future looks bright for mobile wallets and their technology

While COVID-19 was the driving force behind mobile wallet adoption, consumers have quickly become accustomed to the easy-to-use interface and expect to keep using their mobile wallets as frequently:

- 43% of consumers said they were more comfortable with mobile wallets compared to last year.

- 90% of people expect to use their digital wallets with the same frequency after we come out of COVID-19.

- Two-in-five people say it would make sense if we use our mobile phones to make all of our payments in the future.

The results of our survey suggest that the adoption of digital wallets should remain strong across the nation, resulting in greater demand for merchants to provide contactless payment options even after we come out of COVID-19.

Companies must keep up with the rise in demand for digital wallet technology

It’s important for companies to think about how they can enable contactless payment technologies for their customers at scale. Marqeta’s modern card issuing platform and digital wallet card tokenization solution can help companies instantly issue cards into mobile wallets and provide consumers with access to touch-free and secure payment options.

Learn more about Marqeta’s digital wallet and tokenization service

here.

here.