Before launching Marqeta for Banking last year, we devoted a lot of time and energy answering the question, “What is it?” With 40 new banking APIs, it certainly represented an expansion of Marqeta’s modern card issuing platform. The portfolio of seven (so far) modular banking products was key, since they can be deployed together or separately to customize the customer journey and deliver differentiated banking experiences. Our customers have greater ambitions than just launching a card product. They want to be a partner in their end customers’ financial lives – that’s why we launched these new capabilities. To help our customers be able to deliver to their customers.

Positioning Marqeta for Banking as a BaaS offering seemed too limiting. When the space is already crowded, you better be able to deliver something that’s not only better, it needs to be modular and modern. Not only that, but BaaS itself is a term that isn’t well understood. After years of being twisted and warped to satisfy the interests of a broad spectrum of providers, BaaS didn’t really mean anything.

And then our customers and the trade media told us Marqeta for Banking is a BaaS offering. So, let’s break down how we see BaaS.

What is Banking as a Service (BaaS)?

Banking as a Service is an end-to-end model offered by a provider that allows digital banks and other third parties to connect with banks’ systems directly via APIs so they can build banking offerings on top of the providers’ regulated infrastructure . This enables non-bank businesses to embed banking experiences seamlessly and conveniently into their customer journey, building customer loyalty. For banks, BaaS provides incremental revenue and keeps them competitive in an era of disruption.

Traditional banking vs. banking-as-a-service

One of the primary differences between traditional banking and BaaS is ownership of the customer relationship. In traditional banking, the financial institution owns the relationship, which can be a very powerful thing. Consumers generally have strong affinity and loyalty toward their financial institution. After all, they trust them with their money!

The opposite is true in BaaS. The customer’s banking experience is embedded in their interaction with the non-banking company and they are generally unaware of the financial institution involved. The strong feelings of loyalty are 100% directed toward the non-bank company.

That “loss” of the customer relationship is one of the major psychological obstacles that traditional banks need to come to terms with before venturing into BaaS. The fact is, BaaS is unlikely to siphon off existing bank customers; it will primarily attract digital native customers who are not using traditional banks. In most cases, BaaS also removes geographic limitations that often limit who a financial institution serves.

As described in, “Out of the box: Banking-as-a-Service is going modular,” some BaaS offerings have been criticized for being inflexible. They constrain the creativity of innovators, which is the opposite of what BaaS should aim to achieve. After all, many of the non-bank businesses that leverage BaaS offerings do so to create new customer experiences that nobody has imagined yet. Good luck accomplishing that if everyone is using a standard set of tools that don’t allow drawing outside the lines.

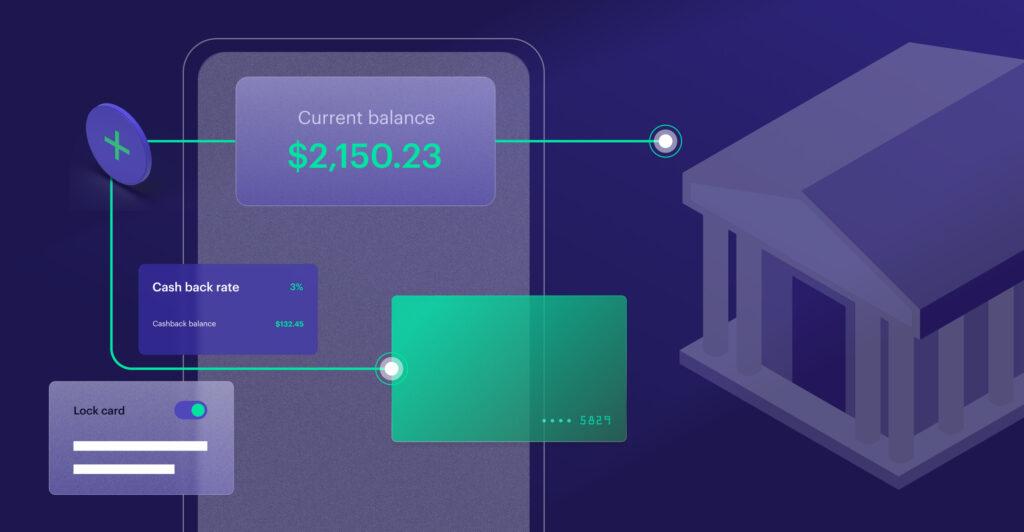

One of the reasons Marqeta for Banking was rolled out is that we see BaaS evolving to include a diverse and modular collection of features. We believe non-banking businesses should have the ability to pick and choose the best banking tools for what they want to accomplish. That’s the only way that innovators will be able to develop truly differentiated financial offerings and customer experiences.

The integration of banking services: embedded finance

Embedded finance is another term that is commonly associated with BaaS. Most of the financial services that are offered by non-banking companies qualify as embedded finance. They are embedded into a customer experience that typically is not banking-centric. For instance, when a consumer is offered a buy now, pay later (BNPL) payment option when checking out, they don’t think about a loan from a bank. They are in the process of buying, and they receive the offer from the retailer or BNPL company in that context. The offer of a loan is embedded into the customer experience.

How to Choose a BaaS Provider

First and foremost, you want a partner that has a successful track record of enabling innovators to develop and launch financial offerings, and bring them to scale. Once you’ve checked that box, consider if their BaaS offerings are flexible to make it possible for you to tailor your banking solutions with modular APIs across cards, accounts, and money movement. Another key thing you should assess is whether your BaaS provider has good relationships with their bank partners. Finally, assess whether you’ll have the control and transparency you need to create the ideal customer experience. That means control at the user level and the transaction level.

Check out how Marqeta is helping our customers to design innovative banking experiences and if you want to learn more about how to choose a BaaS vendor download our whitepaper or get a checklist of things you should be thinking about when you are selecting a vendor.